The Wynford group joins Morneau ShepellFebruary 18, 2021

|

||||||||||||||||||||||||||

COVID-19 Changing How Canadian Organizations Navigate HRFebruary 9, 2021Summary of the 2020 Fall Flash Compensation Projection Survey

The results included in this report are based on over 350 organization’s submissions from across Canada between November and December 2020. This report provides up-to-the-minute insight into 2021 Salary Projections and Human Capital Management strategies currently employed in the workplace. We also provide some year-over-year comparisons to demonstrate the nature of the impact of the pandemic on Human Capital practices.

For more detailed insights and in-depth data, please see our annual Canadian Salary Surveys. Click here for more information. 2021 Salary and Range Projections SummaryAverage Projected Regional 2021 Base Salary Increases:

Including Zeros

Excluding Zeros

National

1.96

2.10

Alberta

1.90

2.16

Atlantic

1.80

1.89

British Columbia

2.00

2.27

Manitoba

1.83

1.92

Ontario

1.95

2.17

Quebec

1.98

2.20

Saskatchewan

1.83

1.96

Average Projected 2021 Base Salary Increases by Industry – Top 5:

Including Zeros

Excluding Zeros

Advanced Technology

2.45

Software Development

2.78

Financial

2.31

Advanced Technology

2.70

Log/Trans/Dist

2.23

IT Service

2.66

Software Development

2.16

Insurance

2.53

Telecommunications/Utility

2.12

Construction

2.50

Average Projected 2021 Base Salary Increases by Industry – Bottom 5:

Including Zeros

Excluding Zeros

Mining

1.26

Not For Profit

1.99

Energy Services

1.18

Manufacturing

1.96

Agriculture/Cannabis

1.11

Mining

1.89

Energy

1.05

Energy

1.68

Hospitality

1.00

Agriculture/Cannabis

1.48

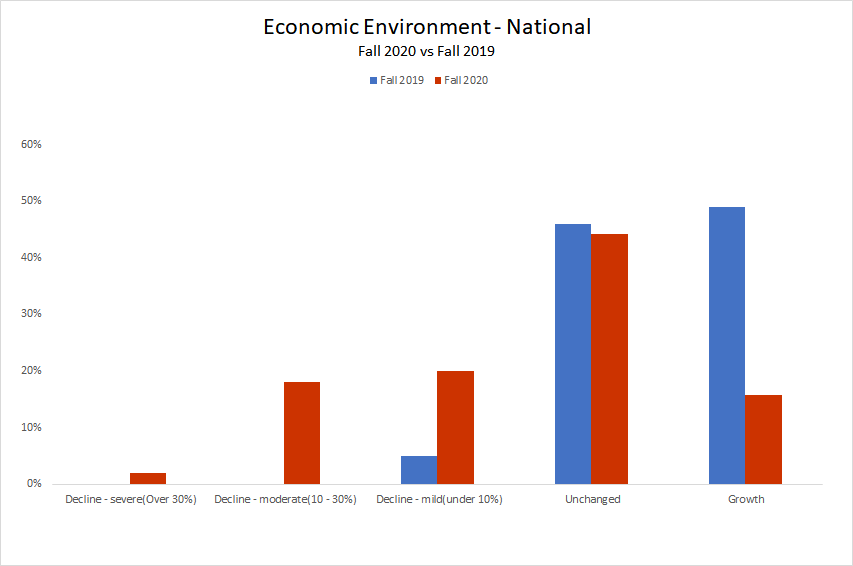

Economic Outlook

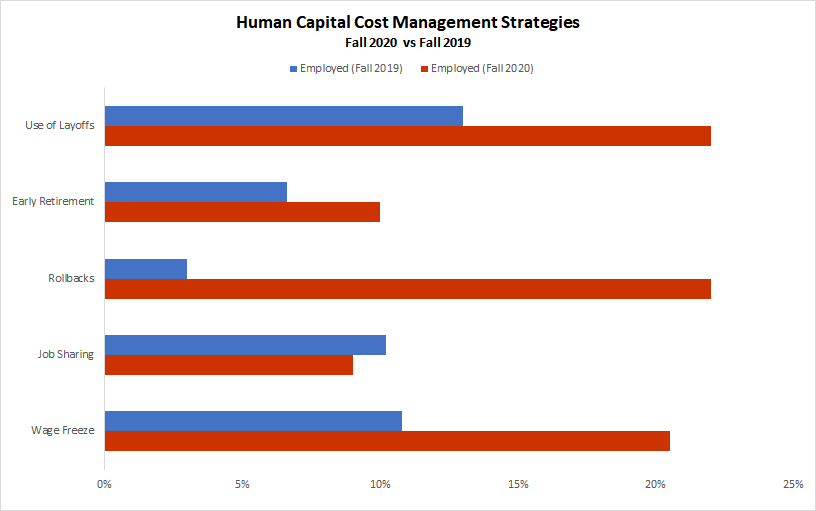

Pandemic Related Human Capital Strategies

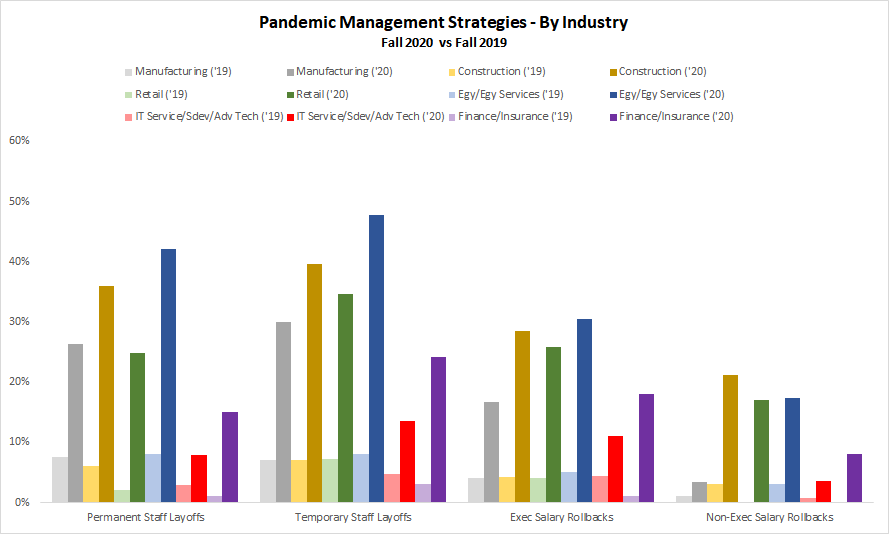

Pandemic Management Strategies

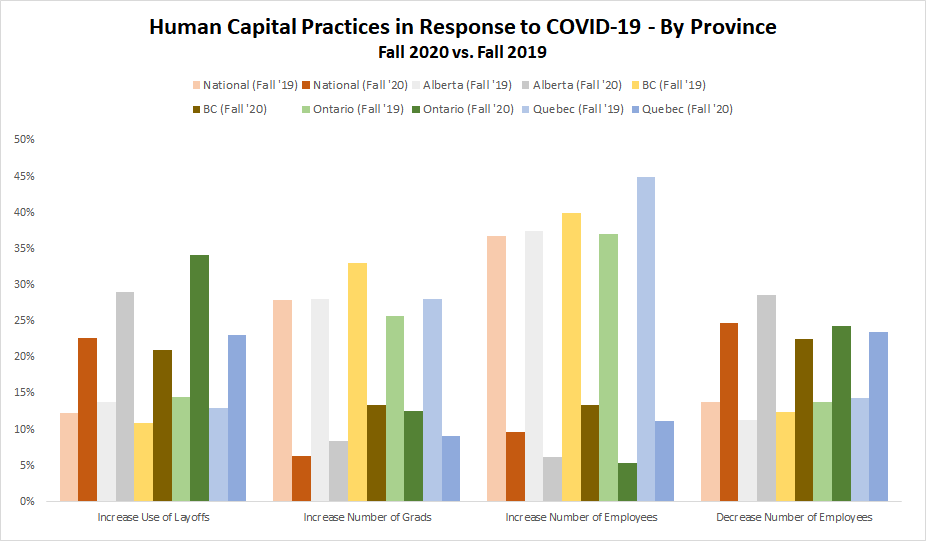

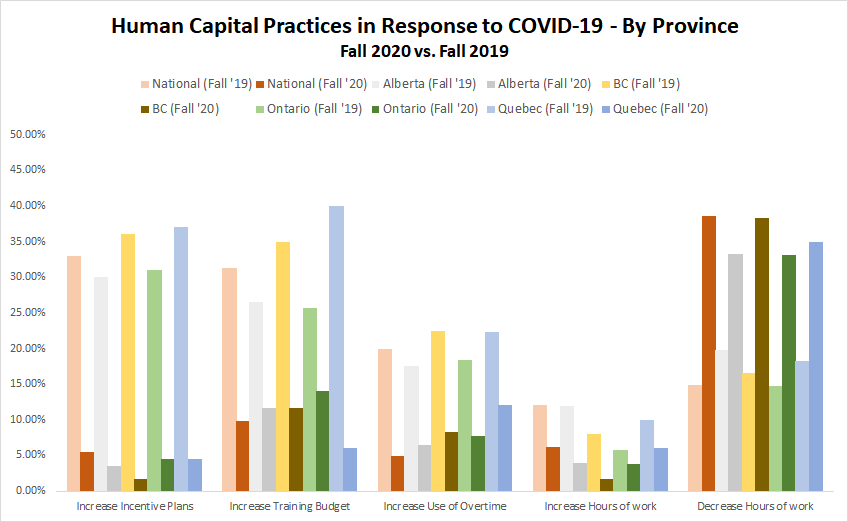

Critical HR Issues in Response to COVID-19

In regards to Critical HR issues, the table below represents the key Human Capital Challenges organizations will need to address in 2021:

Hightlights:

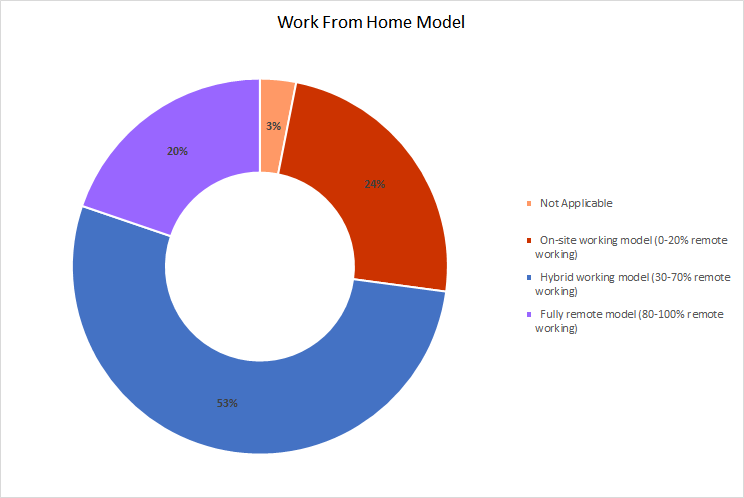

The following table displays which working from home models organizations are most aligned with moving forward from COVID-19:

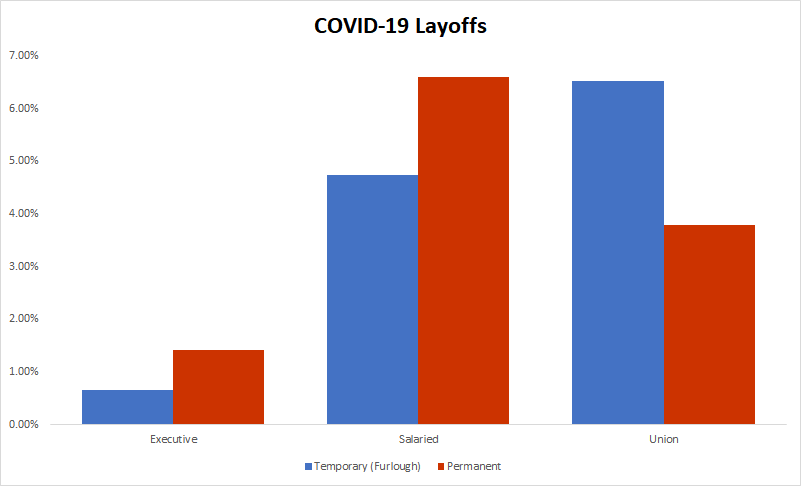

The table below illustrates layoffs due to COVID-19 in the total workforce:

|

||||||||||||||||||||||||||

Gail Evans, Wynford Group Founder Retires!January 29th, 2021It has finally happened! Gail Evans, who founded The Wynford Group in 1991, has "officially" retired at the end of January 2021. Starting as 1 person consulting company, she grew The Wynford Group over the last 30 years, to be one of the largest boutique Total Rewards consulting firms in Western Canada . Her biggest achievement has been the nurturing and development of the Wynford Group Surveys from one Alberta-based technical survey in 1997 to the full suite of 12 national surveys, with a base of over 700 organizations across the country. The Wynford Group surveys further expanded in 2020, with the support of Morneau Shepell, to become the only comprehensive bilingual survey in Canada. With the merger with Morneau Shepell in 2020, Gail is happy to leave the survey and consulting practice in the capable hands of Calgary staff and the other Morneau Shepell offices in Toronto and Montreal. Gail has enjoyed working with many clients and colleagues in sectors across the country and will particularly miss the face to face interaction at the Comp Update sessions that she did in major cities across the country. Although the Wynford Group has been a major part of Gail's life for the last 30 years, it is time to start the next phase. She and her husband are looking forward to lots of leisure activities like golfing, dancing and travelling abroad once COVID settles down. We wish her well in her retirement!

To contact a Consultant:

To contact Technical Support:

|

||||||||||||||||||||||||||